November 9, 2024

Making “Cents” of Surrogacy

Although it can be a dream come true, surrogacy can also be highly expensive for intended parents. From agency fees, to insurance, IVF procedures, attorneys, and financially supporting the surrogate, costs can add up very quickly. While many intended parents view surrogacy as a miracle, they also often face concerns and doubts regarding the financial […]

November 9, 2024

Common Finance and Tax FAQs About Surrogacy

We recently spoke to Gayle East-Garrett, founder and CEO of Surrogate Solutions about concerns common to gestational surrogates and intended parents. Topics that come up frequently, according to Gayle, are finance and tax issues and associated costs in general. Gestational Surrogates “Let me begin by saying that there is never a cost to the gestational […]

November 9, 2024

Pride Month

Navigating the journey towards parenthood within the LGBTQ+ community often involves unique challenges and considerations. Ensuring access to inclusive and supportive fertility practices becomes paramount for individuals or couples seeking assistance. Here are some insightful tips and considerations to identify inclusive fertility clinics: Assessing Inclusivity: Intake and Consent Forms: Check if forms embrace inclusivity by […]

November 9, 2024

Things to consider when choosing a surrogacy agency

If you are a new intended parent who has just begun to explore surrogacy for the first time, you may be feeling overwhelmed. After all, a surrogacy journey is complex. There are many things to consider – from finding a qualified surrogate to executing the necessary legal documents to keeping up with all the medical […]

November 9, 2024

Welcoming a Child After Infertility; Brenda and Ricky’s Surrogacy Story

National Infertility Awareness Week recognizes 1 in 8 couples who struggle with infertility. This describes many of the intended parents (IPs) who turn to Surrogate Solutions for help in creating their families. Once IPs are expecting a child via a gestational carrier, they may experience dual emotions – joy for the impending arrival of their […]

November 9, 2024

8 Children’s Books About Surrogacy

How do you explain surrogacy to a child? Whether it’s to share your child’s unique conception story with them or explain to a sibling that you are expecting their little sister or brother with the help of a gestational carrier, these books can help you start the conversation and explain the process in a way […]

November 9, 2024

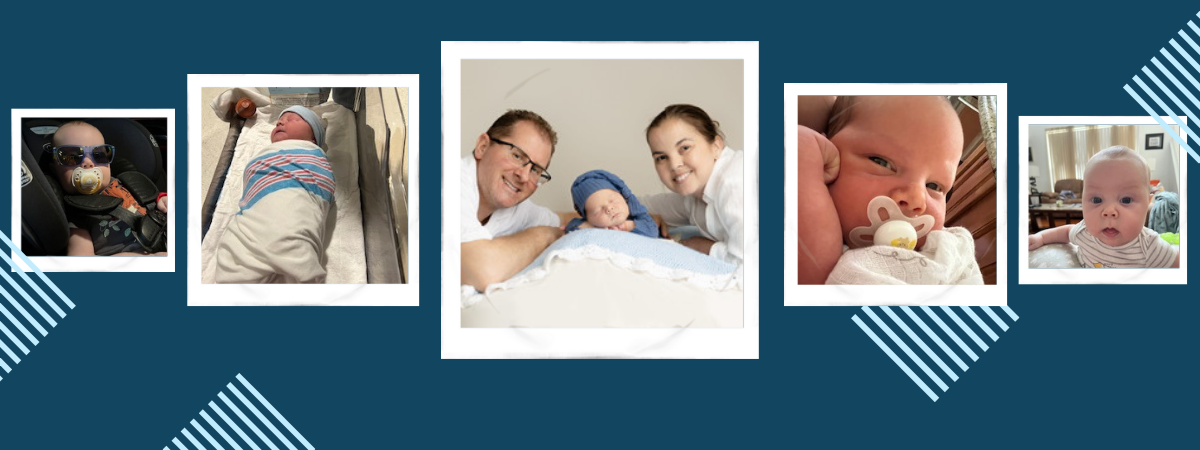

Amber & Nicholas’ Story: A Harrowing Journey

For many couples who choose surrogacy to grow their families, the journey to parenthood is a long one. For new parents Amber and Nicholas, who welcomed their son Sebastian in March, the journey was a marathon more than a decade in the making. Amber and Nicholas met in 2004 and were married in 2008. They […]